County

Ada County Housing Values Part II

After posting the factoid regarding how Ada County arrives at appraised value, it was no surprise to get another view from a private appraiser.

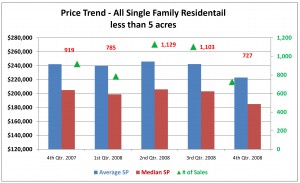

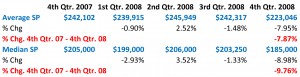

“I do not know where the Assessor obtained the apparent low (-4.0%) median value decline for Ada County single family residences. The data from Multiple Listing Service indicates the median value for single family residences declined 9.76% from the 4th quarter 2007 to the 4th quarter 2008. The data and chart below represents all Ada County single family residential sales

on sites less than 5 acres.

on sites less than 5 acres.

CLICK ON CHARTS TO VIEW

To insure more advertising-free Boise Guardian news, please consider financial support.

January 2, 2009

January 2, 2009

Jan 2, 2009, 3:35 pm

I bought new construction in Boise last year in Dec. The asking price was about $220K, I paid about $199K. The assessor decided it was worth $206K for tax values. The three identical places on my block have been advertised at $189K. It will be interesting to see what the tax folk say this year.

Jan 2, 2009, 5:42 pm

I would advise people to get comps ready right now. Taxes will be based on the values of your property on January 1,2009. We all know our homes are worth a lot less in the market today. It is your responsiblity to prove the assessor valuations wrong and comps are the only way to do it short of an actual appraisal that will cost you money.

Don’t hold your breath for lower taxes as taxes can go up 3% by law every year and you can bet they will be wringing every last dollar they can get from us. This year they have very little new construction to offset tax increases enjoyed in years past.

Local elected governments simply will not do any belt tightening to hold the line on property taxes.

Jan 2, 2009, 7:44 pm

Property taxes are one of the ‘joys’ of home ownership.

I can’t decide which of the ‘joys’ I loved most. I really liked: the mortage, insurance, taxes, maintenance, mowing the lawn, fixing big ticket items, liability, not being able to move when you want to move, the possibility of asset confiscation by courts, government, the IRS, hospitals, etc.

I rent now and do not enjoy paying half as much out of pocket each month, having everything repaired for free, or the ability to leave whenever I want. It is simply no fun at all.

Jan 3, 2009, 10:34 am

Unless Assessor McQuade makes significate downward adjustments to his 2008 assessed values, many properties will be over assessed in 2009. A recent example is xxxx Sabalious Street, Meridian, Idaho. Located in the Vienna Woods Sub. Built 2002. 2008 assessed value of $459,900. Sold 12/31/08 for $325,000. Sold price is 70.7% of it’s 2008 assessed value.

Note: This home appears to have sold in November 2003 for $364,500.

Jan 4, 2009, 12:36 am

Paul: Where do you find comps when nothing is selling?

Jan 4, 2009, 3:25 am

What happened to raising my sales tax to lower my property tax? Now both are obscene.

Jan 4, 2009, 1:02 pm

TJ: You use property value trends from your neighborhood. Use an older sale that is similar and adjust it downward for time. They are available if you look. It might be wise to pick up informtion from properties currently listed in your neighbohood. Compare the listed price with the Assessors 2008 values from the county web site.

Jan 5, 2009, 9:14 pm

Paul, I think the assessments are for the period Jan 1 through Dec 31, 2008. Those are the values we’ll be seeing right AFTER the primaries in May, then you’ll have a few weeks to appeal and you’ll argue your case in the end of June.

I would encourage everyone to appeal if you think your value is too high. There is absolutely no downside. You’ll either get relief or nothing will change. They cannot raise the value at the appeal hearing.

You can use the private appraiser info in your appeal. You can use the assessor’s numbers against him. See what comparable properties are appraised at by McQuade. I did last year and found a wide variance on similar values within 1/2 mile of my house. I appealed and prevailed. The comps the assessor used were from different parts of the county over 8 miles away from my house.

This will be a year when everyone should appeal. Will it overburden the system? Sure, but maybe then the assessor will be forced by the commissioners to start living in the real world.

Jan 8, 2009, 7:23 pm

Does anyone know if auction prices for real estate count? The real market value is what someone is willing to pay for it. What about auction prices last year? How can they use market value if you can’t sell your house? Reminds me of the price value of collateralized mortgage loans. Taxpayers now have to pay for those too.

“Socialism is simply the degenerate capitalism of bankrupt

(and degenerate) capitalists.”

H.L.Mencken