CCDC

CCDC Looking To Expand Influence

With the Central District set to expire in 2017, Boise’s urban renewal is looking for new fields to plow, this time on the Boise Bench according to DON DAY who has a website with details of lots of growth–much of it gleaned from building permit applications and planning and zoning meetings–Good stuff!

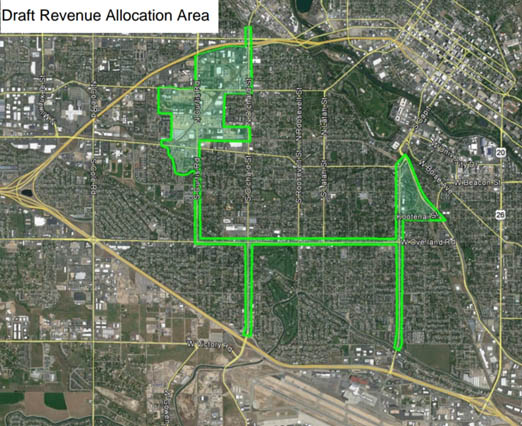

While a group of citizens has worked diligently with the state legislature to limit the scope and authority of urban renewal agencies statewide, the folks at Boise’s Capital City Development Corp. (CCDC) have been working quietly to create a new district outside of the four downtown districts. If they succeed, that will mean property taxes on any new development and tax on appreciated value after a new district is created will be diverted from the city, county, schools, and ACHD. CCDC will be the beneficiary. The prime target of the CCDC expansion is all the commercial property along Vista, Overland, and Curtis.

According to Day, “CCDC officials have been quietly meeting since last year to study the feasibility of adding a fifth urban renewal district in Boise. The CCDC’s original district in the downtown core will formally sunset next year, and in recent years officials have sought to keep the organization alive by adding new responsibilities and expanding the impact of urban renewal to other portions of Boise.”

To insure more advertising-free Boise Guardian news, please consider financial support.

August 1, 2016

August 1, 2016

Aug 1, 2016, 9:24 pm

Quite possibly the secret proposed urban renewal areas are exactly where Daves’s Folly (the transportation circulator) will be located?

Hmmm

Aug 2, 2016, 11:58 am

Urban renewal is one of the few tools that cities have to develop infrastructure. Do you think that Would Boise’s downtown be as vibrant today without CCDC? Doubtful.

Twin Falls’ urban renewal district is doing great things in its core and further out to the Chobani plant. Certainly urban renewal had a distinct impact on bringing that company to the region. I support CCDC expanding onto the bench. It will bring a boost to Vista and Overland for sure.

Aug 2, 2016, 2:43 pm

Hmmmn. I see where the entire petroleum district is enveloped by this new district north of Franklin Rd and through Curtis Rd area. Interesting.

Aug 2, 2016, 3:34 pm

TF Boy, while your point of “it will boost Vista/Overland” may be true you are missing the second part – At what cost?

The cost is the alternative use of the tax dollars. Focus on 1 small area and you are bound to lose focus on the rest of the city.

Do you want brick sidewalks downtown & pretty benches or do you want current I.T. equipment for your children?

Perhaps if downtown CCDC were not sucking up all the tax revenues there would have been plenty of dollars available for Vista/Overland for the past X years and it would already be a nicer area.

Equitable taxes means equitable distribution- not elitism.

IF a downtown is so worthy, a city does not need a “tool to develop infrastructure”. There is this thing called a Downtown Business Association. Private ownership. Private Profits. Public benefits.

Aug 2, 2016, 6:44 pm

Hate to admit it, but this sure looks like a “Desire Called Street Car”. That map has all the earmarks of a street car line linked to the airport.

Aug 2, 2016, 10:42 pm

I am more interested in the sunsetting of the downtown district. Do the properties get reassessed and taxed at the normal levy? What is the projected revenue stream and can it be used to provide some homeowner relief?

I see parts of that new district that may make sense, but not that odd shape drawn? Using property taxes/incremental funding to clean up that tank farm could be pretty costly.

Aug 3, 2016, 9:41 am

Easterner, how many times to I have to repeat myself. The whole rest of the city has been getting tax money spent on it to the detriment of the older parts of town. For decades.

How is that fair?

Boise School District: Look at East Junior High, how much did that cost? And local government can’t even put in a lowly stop light at 15th and Fort to protect North Jr. High kids.

ACHD: Whitewater Parkway was proposed way back in 1968. How many suburban roads and bridges were built before WWP was gotten to. I’ll tell you, a metric boat load.

Boise Parks and Rec: Marianne Williams Park built well before Esther Simplot Park.

Need I go on? I’ve written about this numerous times. I have proven I pay more taxes per square foot than just about any suburban location and yet year after year, decade after decade the lion’s share of tax money is spent in the suburbs.

And you’re leaving out the part that URDs sunset bringing on board far more tax revenue than would otherwise exist, therefore benefitting you.

And, not one person has come up with the actual amount of $ that the existence of URDs costs the taxpayer. Is it $1 per year? Is it $1000 per year? Let’s see your detailed financial accounting before you fly off the handle.

Aug 3, 2016, 11:15 am

Easterner, of course there are trade-offs when you have a set amount of revenue. But there is no practical way for a municipality to create a sinking fund for enhancement and redevelopment, and blight in a downtown core occurs as megastores and strip malls overwhelm a community. That is the function of the private sector. A downtown business assoc does not have the resources to compete on that scale. We elect people for this specific purpose, to enhance the viability of a city. This isn’t a land grab for evil purpose, it is to enhance a neighborhood for the benefit of the entire community.

Aug 3, 2016, 1:36 pm

80% of the people North and East of the Freeway and Cole are pro big government, so it makes perfect sense they’d want to triple their taxes in the next 15 years.

Aug 3, 2016, 6:41 pm

Tax Manic or is that manic troll? I’m already paying triple the taxes of unincorporated Ada and Canyon residents. Dang right I want it spent in my neighborhood instead of widening Overland all the way to Nampa only to bring more Nampans to crowd parks in my neighborhood because their low taxes hasn’t given them any of their own.

Still no proof or even any attempt at accounting for the increase in taxes due to the existence of URDs.

Here. By state law, what is it, only 10% or maybe it’s 6% of the entire county’s property tax base can be in a URD. Currently, Ada County isn’t near that threshold. Of that small percentage, the properties in the URDs are still paying property tax on the base assessment. Only the increment above the base goes solely to the URD. That increment likely would never have existed without the help of the URD.

Furthermore, in the case of the 30th Street URD, 100% of the increment is due to inflation and not due to new construction crowding the area with new residents and businesses clamoring for new services. Explain that.

So take it from here.

Aug 3, 2016, 8:53 pm

For what it’s worth, Ron Harriman of the Tax Accountability Committee of Idaho sent the following which we have excerpted:

“The property tax an urban renewal area uses is a “direct tax” imposed on the citizens of that city and county even if the cities and counties say it is not. In Ada County from 1995-2014 property tax payers have paid an imposed additional $126,921,000.00. Some of these expenditures should have been approved by ballot, as required by the Idaho Constitution, not forced as a tax upon the tax payers.

I have on record the email responses from Ada, Canyon, Minidoka and Kootenai County Assessors confirming that the money paid to an urban renewal agency via TIF funding is shifted to and paid by the property tax payers of the city and county where the urban renewal agency is located. Urban Renewal Agencies, count on the complexities of the issue to keep you uninformed.

If these improvements need to be accomplished the fairest and most equitable method would be to use an LID (local improvement district) wherein the owners of the property affected will pay the cost not the entire county.”

Aug 4, 2016, 10:28 pm

I think that the CCDC is being arrogant about thinking that they and the tool of tax increment financing (TIF) are providing endless long term solutions for Boise. TIF was needed to repair the downtown that was torn down.

But now, wanting to supplement the St. Al’s area? What do they (the CCDC) own up there that they can funnel to a favorite developer? Along Overland? All private ownership. Along Vista? All private, except for the city owned establishments that house the sex offenders.

The TIF formula is bad for schools especially. New businesses, new homes, new parking garages; what about new schools? The schools are just so over crowded it is sorrowful. Imagine trying to teach 30 1st or 2nd graders and meet standards. YOU MUST CARE ABOUT THIS FINANCIALLY WITH YOUR TAX DECISIONS.

Tax increment financing takes that tax money for themselves for the sake of a new looking parking garage at the expense of a variety of other public needs. Realistically, property owners can afford to plant a few trees and set out a few benches of their own – if they have customer with money to spend.

Good studies have been done that describe how this money train goes to developers, not citizens. I think developers should be able to earn their profits in private enterprise in this current Boise boom, and then their increases in value and income from their renters can go to the general public funds, especially the schools.

I am not sure of all the boundaries of all the CCDC areas but I am skeptical that a huge amount of development took place just before the sun-setting of the district plans.

People, individuals who want to earn a living and capitalists come to an area for economic opportunity. CCDC is shifting that opportunity toward a government entity.

Though TIF was the tool for the original downtown area, I think the continuation of that strategy beyond downtown is misguided. The taxes must to go to public need and good, especially schools. Individuals who live in non TIF areas will see their taxes go down and the tax dollar support for the schools go up if we eliminate TIF areas. Not just schools, but police, fire, and library services also. These decision makers don’t have children in the public schools, apparently. If we fail there, what happens to our homeless problem ten years in the future? What happens to our ability to attract business?

And to Twin Falls writer: give us evidence that tax increment financing was the savior of the town of TF instead of just being a way to have a few deal makers take advantage of the public. I have never been impressed in any way by Twin Falls. I would never take private money there for good long term investment.

That is the crux of it all.

TIF seems to take advantage of the town population but doesn’t share the benefit.

Aug 5, 2016, 7:55 am

Mr. Harriman, I particularly like your suggestion of alternative financing options in your article.

At some point equating tax shifts to “permanent tax borrowing” may be a stronger explanation.

Your point about the tax shift can be seen in action in the Ada County budgets of the last four years. (see attached budget proposal)

I reviewed the Ada County budget for 2016/2017 and found the following on page 19 of the proposed budget:

Real property tax increases have averaged over 6.95% percent each year since 2013, with 2015 being the highest at 10.8 %.

A total of a whopping 27.81% in four years.

At the 7/19/2016 BOCC budget hearing/meeting I questioned the wisdom of such inflationary bubble building tax increases.

My allotted time of 3 minutes of comments are at the 35 minute mark on the audio.

https://adacounty.id.gov/Portals/0/WebAppDocuments/Commissioners/Agendas/2016/07%20July/07-19-16%20Tentative%20Budget%20Presentation%20Audio/07-19-16%20Tentative%20Budget%20Presentation.mp3

Lastly,

In the spring of 2013 Commissioner Case released the following statement:

Quote: “We have made it clear our goal is to be more transparent, efficient, and responsive to the public,” Commission Chairman Dave Case stated. “In order to accomplish that, the Board must have a first-hand understanding and direct input into all key business operations of the County. It comes down to running the government as it intended to be – for the citizens – and to being the best stewards of taxpayer money we can be.”

Mr. Case’ re-election to the BOCC is all but a done deal which means that Ada County can look forward to more years of his “first hand” management of Ada Taxpayer mugging.

If you disagree with the current practice of increased reliance on property tax revenues to fund the Ada County budget, contact the BOCC and request an explanation as to why they appear to have developed collective amnesia regarding their stated goals and promises.

https://adacounty.id.gov/commissioners

Aug 5, 2016, 10:46 am

Aggrieved Party, I don’t see where your comment has anything to do with CCDC and URDs.

TIFs need to go, am I talking to myself here? It’s like talking to a brick wall or children. In one ear and out the other.

Answer my questions. How much does the existence of URDs increase your taxes? I’m still waiting. Let’s see the detailed accounting.

Good studies have been done? Name them. So I can study them and make up my own mind.

“huge amount of development took place just before the sun-setting of the district plans.”

Yeah, that’s because it takes years to build up the increment.

“TIF seems to take advantage of the town population but doesn’t share the benefit.”

Ignoring my points again. West Downtown has suffered from tax money funneled to the suburbs for decades. How is this any different? A freeway was punched trough eliminating the traffic that used to sustain Fairview/Main. The freeway benefits you suburbanites more than it benefitted the locals.

Another ignored issue: New planning and zoning regs have been created over the decades that prevent almost any redevelopment of the small lots. There is no free market at work, only micro managing city rules and federal storm water rules.

EDITOR NOTE–Cynic, I previously posted this comment excerpt from Ron Harriman which answers your question. The Statesman ran his complete opinion today.

“The property tax an urban renewal area uses is a “direct tax” imposed on the citizens of that city and county even if the cities and counties say it is not. In Ada County from 1995-2014 property tax payers have paid an imposed additional $126,921,000.00.

Aug 5, 2016, 11:58 am

TIF revenue allocation areas (Urban Renewal Districts) are indeed a financing tool, but like any tool it can be used incorrectly causing more damage than the “blight” problem UR proponents set out to solve. Remember it is the UR district proponents who declared the district “blighted” in the first place. The “cure” for the newly minted “problem” they invented is always a TIF financing scheme based in at best crystal ball projections of hope and prosperity for all those within the TIF revenue allocation area.

Hope is not a plan and the historical performance of UR districts in Idaho have largely not lived up to their promises.

Think of UR TIF financing as pouring gasoline all over your car hoping it will magically soak into the gas tank. Most of it evaporates into the hands of those privileged few (newly minted “Stakeholders”) who always show up to get their “fair” share of TIF generated dollars. (Contractors and other supplicants who can smell money from miles away).

TIF’s are a very blunt financing instrument whose only real goal is that of increasing assessed property values within the TIF district (by hook or by crook).

Sadly, UR managers are not answerable to the average taxpayer. Once established, TIF/UR districts take on a life of their own which can be as long as 24 years regardless of whether the original goals of the UR are accomplished or not.

Experience has shown that curbing the appetite for TIF generated funds is best done proactively by demanding that those who approve the formation of any new UR district agree to limit the scope of projects to be accomplished AND the term of the UR districts BEFORE they are formed.

Experience has shown that in the Treasure Valley, failure to demand such limitations has resulted in “mission creep” which has lead to the creation of unmanageable debt after the UR District sunsets.

The Ford Idaho Center is a perfect example of UR gone terribly wrong. The UR which gave birth to the financing for the then named “Idaho Center” sailed into the sunset in 2004 yet the ongoing costs of operating this voracious consumer of taxpayer dollars continues unabated to this day… at the tune of over a million dollars a year. An average of over $700,000 bucks every year for the last 12 years with no end in sight. Every taxpayer in Canyon County continues to suffer the effects of this boondoggle, with the City of Nampa enjoying the unenviable prize of being the highest taxed city in Idaho over 50,000 in population. (@ $2500 per $100,00 of assessed value)

Onetime costs of “brick and mortar” fixes to deal with “blight” is one thing, but starting ongoing businesses which are directly held in ownership by the UR district are VERY bad ideas.

I smell a “Desire Called Street Car” as well. The TCO or “True Cost of Ownership” of such a project simply cannot be satisfied in 24 years not unless its operation is ceased entirely in 24 years.

This would leave the City of Boise on the hook (just like the City of Nampa is currently with the Ford Idaho Center) to pay for the ongoing costs of operating a public transportation system.

Why? Because when the UR district ends, the UR district cheerfully quitclaims the mess to the municipality which formed the UR district in the first place.

One would think that if “Hindsight is always 20/20” that civic leaders would approach new UR districts with great caution, but that is not the case.

Hope springs eternal in the minds of those who are absolutely sure that THIS time they will get UR right.

Legal challenges to the formation of any UR are currently limited to a 30 day objection “statute of limitation” time period, after which the UR district is set in stone.

Worse yet, the language of the “judicial review” statutes have already been adjudicated as being of no value in determining whether or not the courts can pass judgment on the necessity for allowing a new UR district to be formed. According to Judge Copsey only the Idaho Legislature can delineate the missing guidance parameters upon which the Court could deny or approve a new district.

The upshot of this judgment is that there truly is no real “after the fact” remedy to prevent the formation of any new UR district.

Proponents of new UR districts know this and have lobbied long and hard at the state level to maintain the status quo of current Title 50 UR statutes.

Call your respective City Counsel person and tell them to deny the formation of any new TIF or at least place limitations on their scope and terms!

If the private for profit capitalist sector cannot see the wisdom of undertaking TIF projects, why should the taxpayer be forced to pay for another loss leader?

Aug 6, 2016, 9:45 am

Aggrieved Party wrote: “If the private for profit capitalist sector cannot see the wisdom of undertaking TIF projects, why should the taxpayer be forced to pay for another loss leader?”

I’m not familiar with the details of the Idaho Center, but it sounds like Nampans should find a way to sell it off. You got to admit a lot of spin-off development has occurred around the Garrity exit. How far did the URD boundaries originally extend? Surely the Gateway Center contributes far more tax revenue than did the vacant field it used to be.

Regardless, can we just address this one point. Go to Ada County Assessor’s mapping page and zoom in on Fairview/Main. Then look at the Boise P&Z codes very closely. Private sector redevelopment is virtually impossible. Many of those lots are too small to be changed from their current grandfathered use.

I seriously doubt anyone can argue that the current state of Fairview/Main development is meeting the well known privater sector concept known as highest and best use.

These properties already are NOT contributing what they could or should and it’s because they’re hamstrung. We have 1940s and 50s properties stuck in a 21st Century world of parking requirements, storm water catch basins, ADA requirements, fire sprinklers, oversized sewer and water connections, buried power lines…etc…etc…

And what do you suggest? Throw the baby out with the bath water?

I’m all for more oversight, and sure the URD concept has been abused. Like Ketchum. Does Ketchum really need a URD? But don’t throw the baby out with the bath water.

Aug 6, 2016, 10:50 am

Boisecynic–In fact Nampa has tried informally to sell the Idaho Center with zero interest in anyone buying it. Changes are underway with Council approval to sell or lease up to 3 acres of unused parking lot along Idaho Center Blvd. which hopefully will alleviate to some extent the over $2 million difference between revenue and expenses for the Idaho Center. Also a new management team is in place and early results look hopeful. Gateway center investment has dragged but with Winco building a new store it might help. Idaho Center itself will be a significant drag on Nampa taxpayers for the future.

Grand plans with rosy economic predictions are usually far from reality as is the States projected profits by selling off the golf courses. Who benefits?–not the taxpayer

Aug 6, 2016, 11:56 am

boisecynic:

Most of the answers you proposed are here:

http://www.idahopress.com/members/some-say-the-idaho-center-is-an-investment-in-the/article_b1ab9bac-ec39-11e2-aad7-001a4bcf887a.html

Sell the Idaho Center? It cost 50 million to build and loses a cool million a year. From an income valuation approach Nampa would literally have to pay private equity to take the place AND agree to finance any shortfall for a period of five years afterwards. As you can imagine there never has been or ever will be takers for such a money pit.

When the UR which paid for the Idaho Center ended in 2004, there was $8 million left in the North Nampa Urban Renewal (NNUR) coffers. Instead of selling at a “loss” in 2005, City fathers decided to hope the economy and new management would save the day. So they set aside 5 million for shortfall and rested easy until the money ran out. The 100k per year salaries for the top dogs and a downturn 2008 economy burned down the 5 million in record time.

Over the 10 year lifetime of NNUR the vast majority of this UR project’s “blight eradicating projects” were never funded despite having been identified and touted at the “reasons” for forming the UR in the first place. (The Idaho Center was never mentioned during the formation phase.)

The lesson here is the there can easily be a hidden agenda (pet project) which will only be rolled out AFTER the formation of the new District.

So…what is the REAL reason CCDC wants to form a new district? The pat answers currently being given are just the normal smoke and mirrors excuses to secure permission to form the new District. (Under-performing tax wise…not Highest and Best Use…and my favorite…”Tax levies will DROP after the UR sunsets”..etc.)

The fact remains that without pre-agreed restrictions (pre-District formation) the UR commissioners can agree to do ANYTHING they chose to after the district is formed. A simple majority of the UR Commishes is all it takes to approve an idea or project regardless of what portion of taxpayer hell it is spawned from.

FACT: Oversight from the taxpayer ends permanently 30 days after the formation of the District. NO do-overs, or early termination if you don’t like what they do.

My reference to increasing property values by “hook or by crook” is well founded.

Behind closed doors (executive session) the NNUR commissioners agreed to buy a fully landlocked virtually inaccessible 17 acre piece of agriculturally zoned land. Said parcel tax appraised for $13,500, yet NNUR paid a whopping 1.7 million dollars for it. With interest at 8% the total cost came to 2.2 million.

Such scam sales are actually seen by the assessor’s office as a “willing buyer/willing seller” sale, (what property owner would turn down such an offer!) which qualifies for the basis to raise all other adjacent properties to match the value. Neat trick!

To this day proponents love to tout the “increase in property values” around the Idaho Center. Not hard to do when you prime the pump with taxpayer dollars and buy land for 1200% over it assessed value!

Don’t be surprised that some “lucky” landowner within the boundaries of the proposed new District has already been approached about “selling” their land to the UR District.

Recently, one local and “lucky” UR Commish used his knowledge of a “hidden agenda UR project” and formed a shell corporation which purchased land slated to be bought by the district. To date he has suffered no consequence for what is basically unethical and illegal insider trading.

It is this type of questionable dealing which is as a practical matter unrestricted under UR statutes. Is it wrong? Yes..but who is going to prosecute it? Without penalty, only the moral compass’ of the UR commissioners can save the taxpayer. Good luck with that.

Money in high amounts can, does and has bought many friends. UR districts come to control huge amounts of tax revenues which they dole out without oversight.

UR the way it has been practiced locally has been very bad business for taxpayers, both in the short and long run. Inflation from any source is still inflation!

IMO, promises of eventual levy rate decreases after the end of the UR district term never repays the lost economic opportunity which the taxpayer dollars COULD have done if applied more artfully.

“Trust us and we will talk again in 24 years” is rarely a discussion which is had.

Historic hindsight reveals that most if not all of those who support or promote UR districts have literally died or left the public arena in 24 years after formation and can never be held accountable for their actions.

It is this lack of accountability which breeds the kinds of borderline ethical business practices which a number of UR Commishes have engaged in and seem unable to avoid or refuse to participate in.

On the whole, UR commissioners are the alter-ego of the City Councilors who literally wear both “hats”, and you can be sure that only “yes men and ladies” will ever be appointed to fill any Citizen commissioner slots.

Thankfully, anyone with a complaint about the actions of the UR District is allowed three whole minutes a month to voice their concerns.

Feel free to attend one of these strategically scheduled monthly meetings (usually during the work week in the dead of the afternoon) and watch how the decisions made in executive session are cheerfully trotted out right after they have satisfied the requirement of public comment.

You will need to give the UR district secretary 30 days notice that you wish to participate in “public communication”.

Or you could call your respective City Councilor and demand that this new UR District be abandoned and mercifully euthanized before it is formed.

Don’t forget to thank those who approve such UR districts when they put their candidate hats back on in the fall.

Aug 7, 2016, 9:26 pm

I love that the Guardian has published this story. It is important because the CCDC is supposing it knows better for the use of property than the property owners. There are special deals when these things happen. They must benefit those property owners in a huge way or they would not sign on.

But they cost the average property (home) owner. Or, taking tax paying property out of the main stream and allocating it to TIF payments helps our cities not to look so rich. Therefore taxes for individuals (property owners) continue to provide an increasing amount of money to the cities. How the cities spend it is always a question.

There is not blight on Vista, Overland, or near St. Al’s. There is possibly some lack of maintenance or upgrade, but the properties are occupied and in use. There are zoning laws that can be enforced for those maintenance issues. Maybe the city should enforce them. It is less expensive than taking property off the tax rolls and funneling the money to CCDC for salaries, meetings, parking garages, benches, trees, and advertisements in local media. And interest expenses to the developers who purchase the bonds.

Please tell us the dates and times by which we must object to more URD’s and make our statements. Please.

Funny how the CCDC is defining the blight, drawing the boundaries, and making the development deals.

Please Boise, put CCDC to bed. If we need it it will rise up again.

Aug 8, 2016, 6:24 am

Thanks for the reply aggrieved. You make very good points. This is what I’m worried about. Abuse of URDs may eventually lead to their total demise at the hands of a legislature the majority of whose members have never set foot in the inner city except for nice hotel rooms during the 3 month legislative session. And this hurts areas that truly need help. Meanwhile, what about farm subsidies and the ag exemption? What about church and other non-profit tax exemptions? But that’s a whole other debate.

The Idaho Center seems a special case and comparing it to 1980s downtown Boise or 2000s West Downtown Boise is apples to oranges.

TIF wrote: “There are zoning laws…Maybe the city should enforce them”

Code violations are complaint generated only. If there’s no one around to complain, then, voila, that’s how you get ghetto.

The flight to the suburbs because of inept absentee landlords and their poorly maintained feudal serfdom properties in the inner cities all over America is why we’re in the situation of needing URDs in the first place.

See the irony?

Aug 8, 2016, 11:32 am

I am lumping CCDC/Boise together as they operate pretty closely both daily and with appointments to the board.

It seems they need guaranteed returns with low risk, which is good management practice for a government agency. The only problem is this comes at a cost to other users or taxpayers. Idaho Center is a good example as outlined in the following article on Strong Towns. The TIF also helps get run down areas going but a cost to taxpayers.

Maybe the city should try an experimental approach that has higher risk, but often at less cost and less long term affect to local tax districts. Create an organic growth that is often more successful in the long run. Look at Harris Ranc or Hidden Springs so called planned communties that have little to offer the residents 10 years after buildout. Bown Crossing has been more organic with great success in the “downtown” district.

The following article talks a bit about this and I think could be applied to the proposed area prior to sucking the taxes away. http://www.strongtowns.org/journal/2016/8/8/the-barbell-strategy