Business

Park Land Worth $128,000,000 Up For $15 million Trade

Irate neighbors in SW Boise were provided some deadly ammunition Monday when the Boise School District announced a deal to sell 15 acres of surplus land adjacent to the 160 Murgoitio Park site for $800,000 per acre.

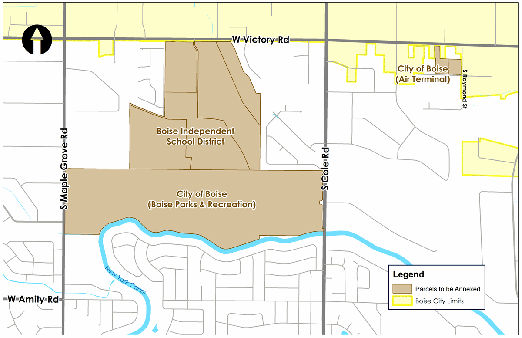

That 160 acre parcel is south of the Victory Road School District headquarters and West Jr. High, between Maple Grove and Cole Roads. It was to be a park, but Boise officials recently announced plans to do a land swap with the Harris Ranch family for foot hills land they claimed is worth $15 million–including the value of lots they are entitled to develop, but will forego.

was to be a park, but Boise officials recently announced plans to do a land swap with the Harris Ranch family for foot hills land they claimed is worth $15 million–including the value of lots they are entitled to develop, but will forego.

Margaret Carmel at BOISE DEV did a great job with one of their trade mark “Deep Dives,” documenting the trade details.

In a nutshell, it appears the deal would avoid the Idaho Code requiring cities to declare land surplus and sell it at auction to the highest bidder. Trades of “equal value” are allowed under the law. By using the trade route Boise City would be able to target the ultimate owner and avoid an auction. The GUARDIAN sees that as “insider trading,” plain and simple. At issue now is the true value of both parcels.

City fathers and mothers obviously were caught off guard when Boise Schools essentially established a “comparison value” for the neighboring 15 acres of land at $800,000 per acre.

The honest way to handle the entire deal would be for the city to sell the Murgoitio Park site at auction, then simply give the Harris folks $15 million cash from the auction proceeds which would logically bring in many millions more than the proposed $15 million trade deal.

To insure more advertising-free Boise Guardian news, please consider financial support.

July 13, 2021

July 13, 2021

Jul 13, 2021, 4:19 pm

Does the neighborhood really want it sold to the highest bidder… CBH?

Jul 13, 2021, 4:21 pm

The land they are trading was never considered for development as it was to be set aside for “permanent open space.”

Jul 13, 2021, 5:57 pm

Where are the legislators who represent southwest Boise? I know Senator Bayer and Rep. Ferch have been fighting for them, but what the legislators from District 18, who also have constituents in the area? They have been silent and seem to have no interest in protecting open space in SW Boise or advocating for their constituents. L

Jul 13, 2021, 6:24 pm

Literally a trademark! 🙂

https://sosbiz.idaho.gov/api/report/FromActiveReport/0/TrademarkCertificate/022179

Jul 13, 2021, 7:02 pm

We love ya Donny boy, but “deep dive” is used by NPR and hundreds of others. I will gladly represent anyone you care to challenge on your so-called trade mark.

Keep up your great work, but don’t try to own the language.

Jul 13, 2021, 10:28 pm

The City’s record shows the $620,000 amount that is stated to be paid to the Airport on this deal is to come out of the Open Space Levy. Voters did not vote yes on this levy to screw-over their fellow citizens.

Jul 14, 2021, 7:10 am

I would say that the legislators in district 18 are busy representing their constituents in SE Boise where they live. The small section of SW Boise that is in that district is not well represented by their legislators.

Jul 14, 2021, 7:26 am

The City Council and Mayor are representing their constituents in the People’s Democratic Republic of the Northend where they too reside. They do not want people living above them in the hills and they also need more places where they can have their dogs poop other than their own yards. People to the south are just taxpayers who failed to live near the river or hills. Draw a map of the Boise High and part of the Timberline High attendance areas and you have the people who matter to the elected folks of Boise government.

Jul 14, 2021, 10:14 am

From a public records request. The first mention of the Murgoitio Land swap was on 2/12/20. HB 413 creating District by Council was passed by the house on 2/13/20. Coincidence? Probably not.

The adjusted Broker Opinion of Value, which adjusted the value down from $65K per acre to $60K per acre, is just not valid anymore. The Caldwell endowment land sale was at $129K per acre. The Eagle Park land auction generated $264K per acre. Now we have $800K per acre.

This needs to be paused, PUBLIC PROCESS REINSTATED. The Public process which has been ignored in order to create a sweetheart deal for the Harris Ranch Family and screw Boise taxpayers over.

The Broker Opinion of Value used no comparable lands. yet the land sales from 2019 and 2020 behind Tablerock and Micron show foothills property values at $9,000 to $15,000 per acre.

This is not a good deal for Boise, for Boise taxpayers, especially West Boise residents who have little open space, despite representing HALF OF BOISE’S POPULATION!

CALL EMAIL POST ON SOCIAL MEDIA, DON’T BE QUIET!

Jul 14, 2021, 11:00 am

“Where are the legislators?”

Leave it to the reformed ultra-Conservatives to want our state government to provide a solution to a local problem.

Barf!!!!!

They’re busy right now objecting to good Public Health policies by trying to interfere with private employment agreements. The BIG government that wants to push their radical opinions —welcome to the Idaho Libertarians.

Jul 14, 2021, 11:30 am

Exactly right, Greg.

Jul 14, 2021, 12:13 pm

Let’s see: $0.8M/acre*160 acres = $128M >> $15M

Jul 14, 2021, 2:35 pm

Beagle boy –

Eh I don’t plan to use it to challenge anyone, unless perhaps someone tried to use the exact same approach right in our lane. Mostly just playing on Dave’s happenstance note of it being a lower-case t trademark. I do everything I can not to pay fees to your fellow Beagles wherever possible.

Jul 14, 2021, 5:47 pm

ASSESSOR!

The foothills property for this swap, includes parcels owned by the Harris Family. Those parcels are being taxed as “Dry Grazing”. Those parcels are part of (adjacent to) development land, and are speculative investment property at best.

Example: 5200 E Barber has 200 acres “valued” at $12,000. The millionaire family paid ONLY $200 in county property tax last year for this land now valued over $5million.

$60 value per acre by the assessor and now it is $26,000/acre for a land swap.

The assessor actually decreased the valuation from 2019 to 2020. Decreased?! Shameful.

The Harris Family is NOT farming! This is now speculative investment property and should NOT be getting an agricultural exemption by any reasonable standard.

IF our legislators TRULY wanted to do anything to help reduce citizens’ burden of property tax, they would amend the ag exemption to EXCLUDE the turd developers from paying nearly NOTHING on their rich properties. An easy fix!

Section 63-604, Idaho Code.

I just recvd a flyer advertising 702 N Riversedge Dr in Eagle for $3,935,000.

The assessor says it is valued at $3,225,600.

$3,935,000 vs $3,225,600. That is 18% difference.

Imagine if your property tax bill was 18% less.

That is a $709,400 difference on this ONE property. Also, about the value of 2 median homes in Ada County. The owner of the property has not been paying tax on that difference. Year after year, after year.

That is 1 high-value property. How many of those are in Ada County?

These ‘farmers’ selling their properties for millions, the developers holding land, and wealthy individuals in Ada County are paying FAR LESS in property taxes than the masses. And someone wants to cry about a non-existing park? There is a bigger problem happening going unnoticed.

To help reduce YOUR property taxes – Idaho Legislators could pass a law for public disclosure just like most other states. Imagine a state law to help all counties and not something to seek revenge on Boise City Council.

Bam! Everyone else pays less and there would be enough money for many parks!

EDITOR NOTE–Readers should be aware the “official value” is set as of January 1 each year. Easterner does have a point in that ag land must be put to “beneficial use” to qualify for the grazing status.

Jul 15, 2021, 6:56 am

Easterner I always find your insights entertaining and sometimes enlightening, but in this case you need to read the statute below.

The gray void in the law allows for many with “marginal” farming practices to take advantage of this exemption. While ridiculous, you should do your research before being so quick to assign blame.

You are correct that many times this statute is used by developers and hobby farmers who use their “bonafide lessees” or “its in a cropland rotation program” to get an exemption and not pay their fair share of taxes, but that is the fault of the legislature writing laws that are so vague that you could drive a ship through all of the loop holes.

63-604. Land actively devoted to agriculture defined. (1) For property tax purposes, land actively devoted to agriculture shall be eligible for appraisal, assessment, and taxation as agricultural property each year it meets one (1) or more of the following qualifications:

(a) The total area of such land, including the homesite, is more than five (5) contiguous acres, and is actively devoted to agriculture, which means:

(i) It is used to produce field crops including, but not limited to, grains, feed crops, fruits and vegetables; or

(ii) It is used to produce nursery stock as defined in section 22-2302(11), Idaho Code; or

(iii) It is used by the owner for the grazing of livestock to be sold as part of a for-profit enterprise or is leased by the owner to a bona fide lessee for grazing purposes; or

(iv) It is in a cropland retirement or rotation program.

(b) The area of such land is five (5) contiguous acres or less and such land has been actively devoted to agriculture within the meaning of subsection (1)(a) of this section during the last three (3) growing seasons; and

(i) It agriculturally produces for sale or home consumption the equivalent of fifteen percent (15%) or more of the owner’s or lessee’s annual gross income; or

(ii) It agriculturally produced gross revenues in the immediately preceding year of one thousand dollars ($1,000) or more. When the area of land is five (5) contiguous acres or less, such land shall be presumed to be nonagricultural land until it is established that the requirements of this subsection have been met.

(2) Land that is contiguous to land qualifying under subsection (1) of this section shall also be appraised, assessed, and taxed as land actively devoted to agriculture if the land:

(a) Consists of pivot corners for a center pivot-irrigated crop, provided such pivot corners are not used for a commercial or residential purpose; or

(b) Is used primarily to store agricultural commodities or agricultural equipment, or both.

(3) Land shall not be classified or valued as agricultural land which is part of a platted subdivision with stated restrictions prohibiting its use for agricultural purposes, whether within or without a city.

(4) Land utilized for the grazing of a horse or other animals kept primarily for personal use or pleasure rather than as part of a bona fide for-profit enterprise shall not be considered to be land actively devoted to agriculture.

(5) Land actively devoted to agriculture, having previously qualified for exemption under this section in the preceding year, or that would have qualified under this section during the current year, shall not lose such qualification due to the owner’s or lessee’s absence in the current year by reason of active military service in a designated combat zone, as defined in section 112 of the Internal Revenue Code. If an owner fails to timely apply for exemption as required in this section solely by reason of active duty in a designated combat zone, as defined in section 112 of the Internal Revenue Code, and the land would otherwise qualify for exemption under this section, then the board of county commissioners of the county in which the land actively devoted to agriculture is located shall refund property taxes, if previously paid, in an amount equal to the exemption that would otherwise have applied.

(6) If the land qualified for exemption pursuant to section 63-602FF, Idaho Code, in 2005, then the land will qualify in 2006 for the exemption pursuant to section 63-602K, Idaho Code, upon the filing of a statement by the owner with the board of county commissioners that the land will be actively devoted to agriculture pursuant to this section in 2006.

(7) For purposes of this section, the act of platting land actively devoted to agriculture does not, in and of itself, cause the land to lose its status as land being actively devoted to agriculture if the land otherwise qualifies for the exemption under this section.

(8) As used in this section:

(a) “Contiguous” means being in actual contact or touching along a boundary or at a point, except no area of land shall be considered not contiguous solely by reason of a roadway or other right-of-way.

(b) “For-profit” means the enterprise will, over some period of time, make or attempt to make a return of income exceeding expenses.

(c) “Platting” means the filing of the drawing, map or plan of a subdivision or a replatting of such, including certification, descriptions and approvals with the proper county or city official.

History:

[63-604, added 1996, ch. 98, sec. 7, p. 360; am. 2001, ch. 12, sec. 1, p. 14; am. 2002, ch. 93, sec. 1, p. 255; am. 2005, ch. 271, sec. 1, p. 835; am. 2006, ch. 233, sec. 2, p. 692; am. 2021, ch. 270, sec. 1, p. 820.]

Jul 15, 2021, 11:38 am

Thanks for being a fan and reaffirming my point, DB. Copy/paste is not necessary, btw, and asked to avoid by the Editor.

“Loopholes”. The Legislature could close such loopholes if they were not working for those people getting the benefit of the loopholes:

-Ag exemption

-Assessor valuation method

-Sales disclosure

-Eliminate URDs

Jul 16, 2021, 10:46 am

“…15 acres of surplus land adjacent to the 160 Murgoitio Park site for $800,000 per acre.”

Seriously? Were there any improvements to this 15 acres that made it worth $12 million? Kudos to BSD for unloading this dry scrub to some out-of-state chumps for 12 rocks.

Jul 19, 2021, 7:57 am

Agree 100% with your points Easterner. The copy/paste was just for you and other readers reference in case they were not able to find the statute that applies to the point you brought up.